Continuing with series on Ross Garnaut's prophesy and his demands that Australia go for zero emissions by 2025 (or sooner). See first:

Economist Ross Garnaut failed to account for Australia's massive, proven capacity as a global climate sink, and the probability of catastrophic bushfires that can arise from mismanaging that asset: Government cannot ignore basic carbon accounting if it wants to combat climate change

Natural Resource Governance Institute states:

National oil companies (NOCs) produce approximately 55 percent of the world’s oil and gas, pumping out an estimated 85 million barrels of oil equivalent per day. The World Bank has estimated that they control up to 90 percent of global oil and gas reserves, thereby serving as gatekeepers for international oil companies’ access to hydrocarbons.

The statement is not hard to understand given that most of the Top 10 oil producers in the world are national oil companies.

1) Saudi Aramco – 10,963,091bbl/day

The Saudi Arabian Oil Company, better known as Saudi Aramco, is the world leader in oil production with a production rate of over 10 million barrels of oil per day (mbbl/day).

The company has the world’s second-largest proven crude oil reserves with 261.5 billion barrels of oil equivalent (BBOe), which accounts for about 10% of the world’s crude oil supply.

Saudi Aramco is also one of the largest and most profitable companies in the world, with a net income of $111.1bn in 2018.

2) Rosneft – 42,17,780bbl/day

Russian integrated energy company Rosneft is the second-largest producer of oil in the world, as well as the world’s largest publicly-traded petroleum company, with a production rate of over 4.2mbbl/day.

The company’s proven hydrocarbon resources are around 41BBOe, with a number of exploration operations increasing Rosneft’s resources in recent years.

Rosneft is the third-largest company in Russia, and accounts for over 40% of Russia’s crude and condensate production. These production levels are expected to continue through to 2021, bolstered by a number of discoveries and projects launched in 2018.

3) KPC – 3,412,203bbl/day

The state-owned Kuwait Petroleum Company (KPC) is the third-largest producer of oil in the world, with a production rate of over 3.4mbbl/day.

The company produces approximately 7% of the world’s total crude oil, with proven reserves of about 111BBOe.

At the end of 2018, KPC announced an investment plan worth approximately $115bn, as part of its intention to increase oil production to 4mbbl/day by 2020.

4) NIOC – 3,256,486bbl/day

The National Iranian Oil Company (NIOC) is an important company in the oil and gas market despite US-imposed sanctions on Iran, with a production rate of over 3.2mbbl/day.

While the sanctions placed on Iran due to the country’s nuclear programme have deterred overseas investments in Iranian oil and gas, the NIOC continues to invest in exploration projects to utilise the 200 undeveloped oil and gas fields in the country.

5) CNPC – 2,981,246bbl/day

The state-owned China National Petroleum Company (CNPC) is the largest producer of oil in East Asia, with a production rate of just under 3mbbl/day.

CNPC is also one of the largest oil and gas companies by revenue, with revenues of $326bn The company ranked #4 in Forbes’ Global Fortune 500 from 2017-2019.

The company’s international diversification in recent years has contributed to its influence in the global energy market, even with the ongoing trade dispute between China and the US.

6) ExxonMobil – 2,294,701bbl/day

As a member of “Big Oil,” American energy company ExxonMobil is one of the world’s most influential companies and the largest producer by oil in the US, with a production rate of 2.3mbbl/day.

ExxonMobil is also one the world’s largest companies by revenue, with revenues of $244.3bn.

The company has recently expanded its global portfolio through a number of overseas exploration and production projects, in addition to increased production in the US.

7) Petrobras – 1,987,950bbl/day

Brazilian multinational Petroleo Brasiliero, better known as Petrobras, is the largest producer of oil in South America with a production rate of just under 2mbbl/day.

Petrobras is one of the most influential companies in the oil and gas industry, ranking at #73 in the 2018 Global Fortune 500.

While the company has struggled with corruption scandals and debt woes in recent years, Petrobras has shown signs of recovery and is involved in a number of planned exploration and production projects.

8) ADNOC – 1,973,135bbl/day

With a production rate of just under 2mbbl/day, the UAE’s state-owned Abu Dhabi National Oil Company (ADNOC) is a significant player in the Organization of the Petroleum Exporting Countries (OPEC).

The company works with overseas contractors and multinationals to expand the UAE’s offshore industry. Recently, this includes initiating exploration bidding rounds for blocks in the UAE and awarding a number of contracts to develop offshore oil and gas in the country.

9) Chevron – 1,830,537bbl/day

American multinational Chevron was one of the “Seven Sisters” that dominated the global oil and gas industry from 1940-1970 and continues to be an influential company in modern markets, with a production rate of 1.8mbbl/day.

In April 2019 Chevron signed a deal to acquire hydrocarbon exploration company Anadarko for $50bn, but this merger deal is likely to be terminated following Occidental Petroleum’s acquisition of Anadarko in May 2019.

10) Pemex – 1,813,360bbl/day

State-owned petroleum company Petroleo Mexicanos, better known as Pemex, is one of the largest companies in Latin America with a production rate of 1.8mbbl/day.

Although Pemex has had problems with debt in recent years, the company has invested in a number of operations over 2018 to mitigate its financial woes and boost its crude output.

Note that Exxon and Chevron rely heavily on good relations with national oil companies in order to access reserves outside the United States.These remain a significant part of their production.

The extent of state involvement and control gets clearer once the the ownership and business of the Top 250 Energy companies as ranked by Platts is analysed.

How a zero emissions policy, indeed any level of "de-carbonisation" of the Australian economy is going to influence of or affect the output of any of the above is hard to understand, unless of course one lives in one of Garnaut's economic models.

The degree of irrelevance is more stark when one considers that Australian policies are not likely to matter to NOCs in the neighbourhood:

1. China

China is the biggest oil producer in the region by a substantial margin, accounting for nearly 4 million barrels of oil per day. It is responsible for almost half of Asia's total production and announced in 2019 that it would increase capital investment in oil production by 20%. China hopes to increase its output by 50% to 6 million barrels per day by 2025 to become more energy independent, as the country imports roughly 10 million barrels per day to meet domestic demand.

KEY TAKEAWAYS

- The biggest oil producers in Asia are China, India, and Indonesia.

- China accounts for almost half of the total production in Asia and imports additional oil to meet domestic demand.

- Malaysia, Thailand, and Vietnam are also among the largest oil producers in Asia.

- Overall oil production in the Asia Pacific is declining because new discoveries are not enough to offset the lost output from aging oilfields.

- Demand remains strong, however, with the Asia Pacific consuming 35% of the world's oil production.

The oil industry in China is led by several of the largest energy companies in the world: China Petroleum and Chemical Corporation, known as Sinopec; China National Offshore Oil Corporation, or CNOOC; and PetroChina. These three companies combine to produce more than two-thirds of the country's total annual production.

2. India

India accounts for production of about 2.5 million barrels per day. While production growth has steadied in recent years, oil consumption in India continues to grow by leaps and bounds. India ranks as the third-largest oil importer in the world after U.S. and China.

Oil production in India is dominated by the state-owned enterprise, Oil and Natural Gas Corporation, which accounted for roughly 75% of domestic production. Cairn India Limited, the Indian subsidiary of the British oil and gas company, Cairn Energy PLC, is the second-largest contributor to India's oil market.

3. Indonesia

Indonesia comes in behind India with the production of about 835,000 barrels per day. In the 1990s, when production was at a high, Indonesia produced between 1.5 million and 1.7 million barrels per day. Since that period, however, production has followed a nearly unbroken downward trend to the current level. In 2009, the combination of declining production in aging oil fields along with rising domestic demand compelled Indonesia to exit the Organization of Petroleum Exporting Countries (OPEC), of which it had been a member since 1962.

PT Chevron Pacific Indonesia, a subsidiary of the American energy giant Chevron Corporation, is Indonesia's biggest oil producer, accounting for an estimated 40% of production, while Indonesia's state-owned energy company, PT Pertamina, is responsible for an additional 25%. Foreign oil companies including Total SA, ConocoPhillips, and CNOOC are also significant producers in the region.

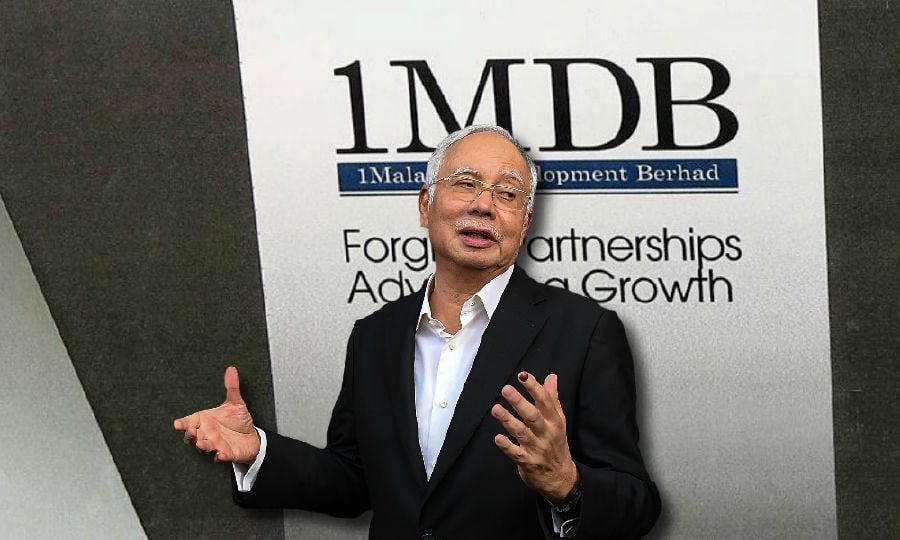

4. Malaysia

Malaysia produces about 661,000 barrels of oil per day, most of which is extracted from offshore fields. Over the course of more than two decades since 1991, production in the country fluctuated between 650,000 and 850,000 barrels per day. According to the Energy Information Association, the recent downward production trends can be attributed largely to declining output at aging oil fields. The Malaysian government is responding by encouraging investment in recovery technology and new field development.

Petroliam Nasional Berhad, also known as Petronas, is Malaysia's state-owned energy corporation. It controls all oil and gas resources in the country and is responsible for development of those assets. International integrated oil and gas companies, such as Exxon Mobil Corporation, Murphy Oil Corporation, and Royal Dutch Shell PLC, are involved with Petronas in oil production activities in Malaysia, including partnerships in enhanced oil recovery projects at aging oil fields.

5. Vietnam

Vietnam has maintained oil production volumes between 300,000 and 400,000 barrels per day since 2000 and daily production in 2018 amounted to just over 300,000 barrels. In 2011, offshore exploration and drilling activities raised Vietnam's proven oil reserves from 600 million barrels to 4.4 billion barrels, rocketing it into third place in Asia after China and India. Industry analysts expect further discoveries as exploration of Vietnam's offshore waters continues.

80.5 Million

The number of barrels of oil produced each day globally.

Vietnam's state-owned oil and gas company, PetroVietnam Gas Joint Stock Corporation, is involved in all oil production in Vietnam via its production subsidiary, PetroVietnam Exploration Production Corporation, and its joint ventures with international oil companies. Chevron, Exxon Mobil, and the Russian company, Zarubezhneft OAO, are several of the largest international producers operating in Vietnam.

6. Thailand

Oil production in Thailand has been steady around 250,000 barrels daily for the past decade. However, when it began oil production in 1980, the country generated only 1,300 barrels per day. Despite this growth, Thailand must import large quantities of oil to meet domestic demand.

Chevron is the main oil producer in Thailand. It operates Thailand's largest oil field, Benjamas, and has investments in many other important production sites in the country. Thailand's state-owned oil company, PTT Exploration and Production, is the country's second-largest oil producer. Other international companies involved in oil production in Thailand include Coastal Energy Company and Salamander Energy PLC.