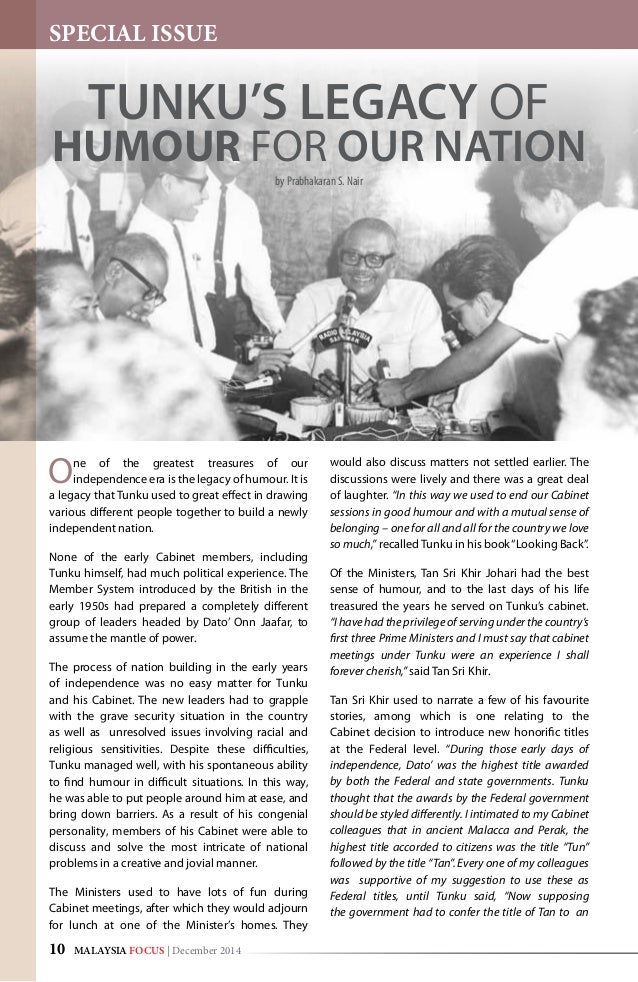

The provident fund is paying A$154mil for a 49% stake in Yarra Park City Pty Ltd (YPC), which holds the rights to a five-acre mixed-use development worth over RM9bil in Melbourne. The remaining 51% interest in YPC is held by PJ Development Holdings Bhd (PJD), which is a subsidiary of OSK. The Melbourne project also marked the fund’s second development venture overseas after the Battersea project in London. (Picture shows: Ong Leong Huat (second from left) exchanging documents with Shahril. With them are OSK deputy group managing director Ong Ju Yan and EPF head of private markets department Rohaya Mohammad Yusof.)

The AFR reported in February this year:

To be known as Melbourne Square, the project will transform a city-fringe block into a vertical village with six towers linked by a network of elevated gardens.

Then known as PJ Development, the Malaysian developer paid a record $145 million to acquire the city fringe site in June 2014 from interests associated with the Mario LoGiudice's Banco Group.

Today ,Thursday, 6 April 2017 The Star reported:

The Employees Provident Fund is paying A$154mil for a 49% stake in Yarra Park City Pty Ltd (YPC), which holds the rights to a five-acre mixed-use development worth over RM9bil in Melbourne.

The remaining 51% interest in YPC is held by PJ Development Holdings Bhd (PJD), which is a subsidiary of OSK.

In essence OSK;s PJD makes a profit of AUD 38.2 million ((RM129mil) upfront, enjoys a forex gain of RM 49.2 million, and gets the EPF to pay for the entire purchase cost, while still controlling the development company.

As for the AUD 2.8 Billion Gross Development Value (GDV)?Recall that it does not mean anything to the EPF until and unless the project makes a profit, and that profit is paid over to the EPF in dividends.

END

See also

Aussie Banks: Property Bubble Fears Raise Alarm

Barron's-4 Apr. 2017

Thursday, 6 April 2017

EPF buys stake in OSK’s Aussie project

BY EUGENE MAHALINGAM

Feb 23 2017 at 12:15 AM

Updated Feb 23 2017 at 12:15 AM

Barron's-4 Apr. 2017

Thursday, 6 April 2017

EPF buys stake in OSK’s Aussie project

BY EUGENE MAHALINGAM

PETALING JAYA: The Employees Provident Fund (EPF) is making a new investment in properties overseas after a year-long hiatus, this time by taking a significant stake in a Malaysian-owned development project in Australia.

The provident fund is paying A$154mil for a 49% stake in Yarra Park City Pty Ltd (YPC), which holds the rights to a five-acre mixed-use development worth over RM9bil in Melbourne.

The remaining 51% interest in YPC is held by PJ Development Holdings Bhd (PJD), which is a subsidiary of OSK.

The Melbourne project also marked the fund’s second development venture overseas after the Battersea project in London.

In a statement, EPF chief executive officer (CEO) Datuk Shahril Ridza Ridzuan said the Melbourne Square project met EPF’s long-term objectives and would be a good addition to its overseas portfolio.

“The increasing demand for residential property in Melbourne will enable the EPF to generate returns for its members,” he pointed out.

In the statement, OSK said the Melbourne Square development would transform a former carpark bounded by the Westgate Freeway and Kavanagh, Balston and Power Streets in Southbank into a dynamic mixed-use community and retail centre, with an expected gross development value (GDV) of A$2.8bil (RM9.4bil).

OSK CEO and group managing director Tan Sri Ong Leong Huat said the Melbourne Square project was one of the last sizeable prime land available for an iconic development in the city.

“We are delighted to partner the EPF on this exciting project,” he said.

“The project will mark OSK’s maiden foray into Melbourne, whose growing population and vibrant property market have received much interest from international developers in recent years, including several established Malaysian developers,” he pointed out.

The project comprises four towers of residential apartments, an office tower, a hotel/serviced apartment tower and multiple street-level retail lots across the various components.

It will be developed in five stages over eight to 10 years.

Slated for residential use, the towers have a capacity of over 1,000 apartments, with a GDV of over A$900mil.

In a filing with Bursa Malaysia, OSK said its unit PJD had entered into a share sale agreement with the EPF to dispose of its entire stake in Yarra Development Holdings (Australia) Sdn Bhd (Yarra Holdings), which is a wholly-owned subsidiary of PJD.

Subsequently, OSK said its indirect subsidiary, Yarra Australia Development Pty Ltd, had entered into a share subscription agreement with YPC to subscribe to 110.49 million shares or 49% of the entire enlarged paid-up share capital of YPC.

“The disposal and YPC subscription are expected to increase the net earnings of the OSK group by A$38.2mil (RM129mil) and a foreign-exchange gain on the total investment in YPC of RM49.2mil, which was previously recorded as foreign-exchange reserve; or a total increase of 12.86 sen per share for the financial year ending Dec 31, 2017,” said OSK.

It said Yarra Holdings had applied for a credit facility of up to A$175mil from CIMB Bank Bhd, OCBC Bank (M) Bhd and RHB Bank Bhd. YPC has appointed a list of top-tier consultants for the project, including Cox Architects to design the master plan and Stage One of the project, Carr Design for interior design services, Sinclair Brook for project management and CBRE as the sales agent for Stage One, which has just been launched this month.

Malaysia's OSK gets OK for massive

Melbourne project

Malaysia's OSK Property has won approval for the first stage of a $2.8 billion mixed-use project in Melbourne's Southbank, one of the largest single development proposals ever put to the state's planning authorities.

To be known as Melbourne Square, the project will transform a city-fringe block into a vertical village with six towers linked by a network of elevated gardens.

Designed by Cox Architecture, almost a fifth of the huge site will be devoted to public realm with a park, a shopping centre, childcare facility, and specialty stores.

The overall proposal is to build the six towers, ranging in height from 30 levels to 65 levels with the tallest 226 metres, on a two-hectare car-park site at 93-119 Kavanagh Street.

It includes 60,000 square metres of office space, a hotel and serviced apartment tower with 687 rooms and four apartment towers with 2610 apartments, and a childcare centre.

The first stage now approved will comprise the park as well as two upmarket towers with more than 1000 apartments. Pre-sales for the apartments are due to get under way this year.

It includes 60,000 square metres of office space, a hotel and serviced apartment tower with 687 rooms and four apartment towers with 2610 apartments, and a childcare centre.

The first stage now approved will comprise the park as well as two upmarket towers with more than 1000 apartments. Pre-sales for the apartments are due to get under way this year.

Key destination

"It is our hope that Melbourne Square will be an important destination within the world's most liveable city," said OSK's chairman, Tan Sri Ong Leong Huat, in a statement.

Cox Architecture worked with landscape architects Rush Wright Associates for the masterplan and Taylor Cullity Lethlean for the first stage.

"A deliberate decision was made to significantly exceed the open space area requirements," said Cox director Ian Sutter.

Then known as PJ Development, the Malaysian developer paid a record $145 million to acquire the city fringe site in June 2014 from interests associated with the Mario LoGiudice's Banco Group.

The company is controlled by one of Malaysia's richest men, Ong Leong Huat. In December 2015, PJ Development paid $27.8 million to Quintessential Equity for a suburban Sydney office building.

Melbourne is popular with Malaysian developers, such as SP Setia which has five Australian sites and last year lodged plans for a $640 million twin tower project in central Melbourne.

Giant Malaysian sovereign developer UEM Sunrise has a substantial pipeline as well, including the $770 million, 92-storey Aurora Melbourne Central residential tower.

Giant Malaysian sovereign developer UEM Sunrise has a substantial pipeline as well, including the $770 million, 92-storey Aurora Melbourne Central residential tower.