by Ganesh Sahathevan

New Zealand Prime Minister John Key presented Datuk Seri Najib Razak with a

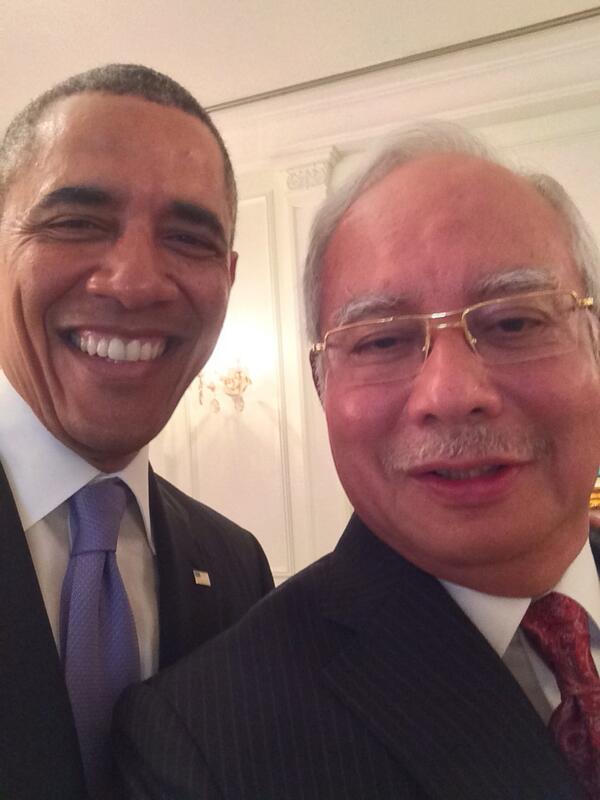

Pix courtesy of Prime Minister's Office

This writer has previously shown how Obama's UNSC Israel Resolution is tainted by bias because co-sponsors New Zealand and Malaysia are both compromised by the 1MDB scandal.

The New Zealand Government has since become further compromised by refusing to enforce its own anti-money laundering and counter-terrorist financing laws against the family of one Low Hock Peng, which includes eldest son Jho Low who is said to be a central figure in the 1MDB theft.

The Lows have gone before the High Court in Auckland, New Zealand ,in order to substitute the trustees of a trust used to hide 1MDB related assets,so that the US DOJ's seizure of those assets might be challenged. They have succeeded in obtaining those orders against their trustees Rothschild Trust New Zealand, who feared being found criminally liable if they challenged the DOJ seizure.

The decision of the court in granting the Lows the orders they sought is a technical one based on the law of trusts and has little if anything to do with US DOJ action:

"Given the true nature of this proceeding, the background and extensive news media interest," Justice Toogood said it would be necessary for him to give a judgment which contains background "and perhaps emphasises what this proceeding does not involve".

"The central issue here is whether or not the beneficiaries are entitled to seek replacement of the trustees so they can resist the US proceedings, without this court needing to express any view about the merits" of the US allegations, Justice Toogood said. "The judgment would simply reflect the general nature of the allegations."

However, regardless of those orders , the fact remains that the New Zealand Government despite now being clearly made aware of the matter of the Lows using New Zealand as a shelter for their tainted assets, refuses to enforce its own AML/CTF regulations and seems determined to ensure that the Lows are unhindered in their criminal enterprise.

It is a matter of public record that the beneficiaries of the 1MDB scandal include Malaysia's PM Najib and well as Saudi prince Turki Abdullah , a son of the late King Abdullah.

The case against New Zealand as a party tainted by bias when it moved Obama's UN Resolution against Israeli settlements grows even stronger. That case may now include elements of terrorist financing.

This writer has previously shown how Obama's UNSC Israel Resolution is tainted by bias because co-sponsors New Zealand and Malaysia are both compromised by the 1MDB scandal.

The New Zealand Government has since become further compromised by refusing to enforce its own anti-money laundering and counter-terrorist financing laws against the family of one Low Hock Peng, which includes eldest son Jho Low who is said to be a central figure in the 1MDB theft.

The Lows have gone before the High Court in Auckland, New Zealand ,in order to substitute the trustees of a trust used to hide 1MDB related assets,so that the US DOJ's seizure of those assets might be challenged. They have succeeded in obtaining those orders against their trustees Rothschild Trust New Zealand, who feared being found criminally liable if they challenged the DOJ seizure.

The decision of the court in granting the Lows the orders they sought is a technical one based on the law of trusts and has little if anything to do with US DOJ action:

"Given the true nature of this proceeding, the background and extensive news media interest," Justice Toogood said it would be necessary for him to give a judgment which contains background "and perhaps emphasises what this proceeding does not involve".

"The central issue here is whether or not the beneficiaries are entitled to seek replacement of the trustees so they can resist the US proceedings, without this court needing to express any view about the merits" of the US allegations, Justice Toogood said. "The judgment would simply reflect the general nature of the allegations."

However, regardless of those orders , the fact remains that the New Zealand Government despite now being clearly made aware of the matter of the Lows using New Zealand as a shelter for their tainted assets, refuses to enforce its own AML/CTF regulations and seems determined to ensure that the Lows are unhindered in their criminal enterprise.

It is a matter of public record that the beneficiaries of the 1MDB scandal include Malaysia's PM Najib and well as Saudi prince Turki Abdullah , a son of the late King Abdullah.

The case against New Zealand as a party tainted by bias when it moved Obama's UN Resolution against Israeli settlements grows even stronger. That case may now include elements of terrorist financing.

END

Mohd Najib Tun Razak

Mohd Najib Tun Razak