CCCI is a wholly-owned subsidiary of CCCC

It has been previously reported on this blog that the Australian Government approved the John Holland-CCCC takeover in 2014 despite Holland' 60 years worth of intelligence gathered from past and ongoing Defense contracts.

The Secretary of the Department Of Defence at the relevant time (between 2012 and 2017) was Dennis Richardson, who seems not to have objected to the deal despite the obvious security and intelligence issues. He is also a former head of the Australian Security And Intelligence Organisation (ASIO).

There are now even more reasons to question his judgement. The investigative news site Sarawak Report has provided details of how CCCC conducts business; in its case how CCCC was happy to help cover-up the 1MDB theft, which has been described as the largest case of kleptocracy the world has ever seen. CCCC's business practises would not surprise anyone in East and South East who is or has been involved in business, security or intelligence. Richardson however seems to think that he has a better, more sophisticated view of such matters.

END

How Jho Low Created A New Front For 1MDB Kickbacks In Kuwait EXCLUSIVE

The Malaysian financial fixer Jho Low had been on the phone to his contacts, according to a source who witnessed the call. It was June 2016 and the location was the luxurious home of the family of the then Kuwaiti prime minister Sheikh Jaber Al-Mubarak Al-Hamad Al-Sabah.

With Jho Low were the prime minister’s two sons, Sheikh Fahd Jaber Al-Mubarak Al-Hamad Al-Sabah who held the position as chief of staff in the government and his elder brother, Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah (Sheikh Sabah) who had adopted the role of the main businessman in the family.

By early 2016 the family through Sheikh Sabah had entered into a number of business arrangements with Jho Low whereby they agreed to facilitate major purported plans on the part of the Chinese government-backed Silk Road and Economic Belt initiative through the so-called Silk Road Integrated Real Estate Fund (the “SRIREF”) in Kuwait.

Sheikh Sabah and Jho Low at a ceremony in the al-Sabah mansion April 2016

Jho Low’s introduction to the Al Sabah family had initially been made, reliable informants have told Sarawak Report, through representations by high ranking people in the government of Malaysia. They say that on his visits to Kuwait the businessman was treated as the representative of Prime Minister Najib Razak, according to protocols reserved for people of diplomatic status.

“He was introduced to the Al Sabah household under full diplomatic protocol accompanied by the Chinese ambassador. We were told he was the representative of the Malaysian prime minister and wanted us to facilitate planned investments involving Malaysia and China”

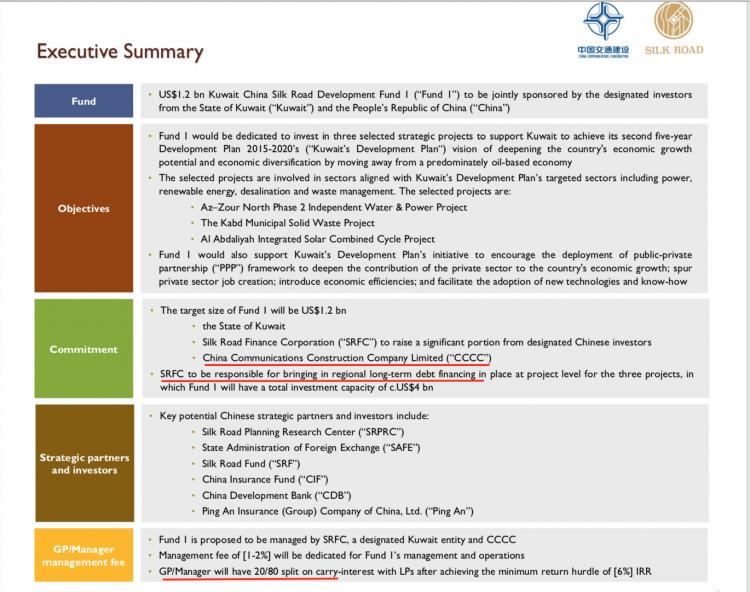

As a 17 page document sent to the Al Sabah family by Jho Low in May 2016 explained the proposal was for an US$8 billion investment in major projects in the state sponsored by the Silk Road company and also, significantly, the Chinese Communications and Construction Company (CCCC), which was at that time negotiating with Najib in Malaysia to clinch the multi-billion ringgit East Coast Rail Line initiative (ECRL).

A 17 page prospectus sent by Jho Low to the Al Sabah family in May 2016 outlined the major infrastructure plans under an $8 billion proposal sponsored by China’s CCCC and Silk Road companies

According to the witness at the Sheikh Sabah home:

After the call he [Jho Low] told us he had good news on the “silly stuff” about 1MDB. The Malaysian contract with CCCC had been “upgraded” and as a result the ‘silly stuff’ would be taken care of by the Chinese.

He [Jho Low] explained that the people from CCCC were very pleased about the ‘upgrade’ as it represented a huge increase on the profit margin for them of at least 200%. In return they would pay commission to the prime minister, Najib Razak, of US$3 billion and that would come through Kuwait, which would represent big money for Jho Low and his business partner Sheikh Sabah.

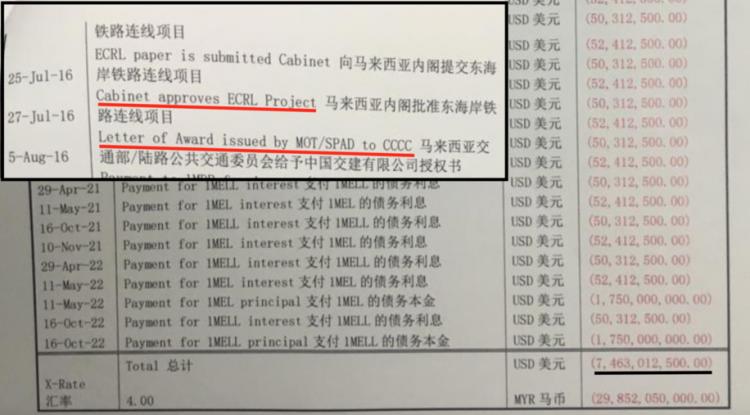

Evidence, testimony and surrounding developments make clear that the contract Jho Low was referring to was indeed Malaysia’s East Coast Railway initiative (ECRL), the projected cost of which was formally inflated by 100% when it was presented for approval to the Malaysian Cabinet a few weeks later in July (a matter revealed by Sarawak Report at the time). Prime Minister/Finance Minister Najib Razak flew to Beijing in November to ratify the agreement.

It suggests there was a parallel agenda to Jho Low’s investment proposals being made on behalf of China in Kuwait, which started to become clearer as events unfolded.

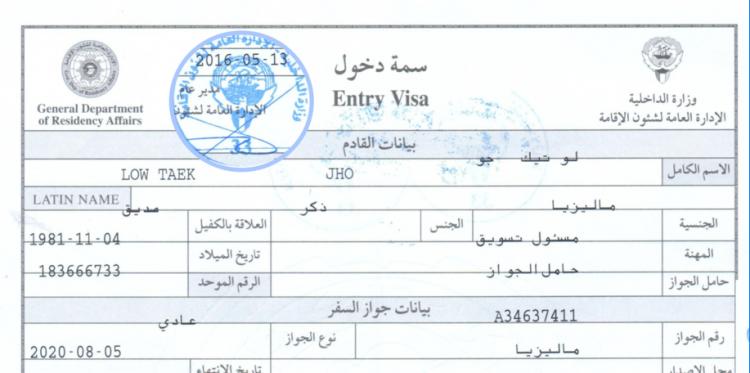

At the sidelines of formal meetings and ceremonies between the Al-Sabah family and Chinese official visitors -Jho Low and colleague Seet Li Lin were awarded VIP visas to Kuwait to conduct business in 2016

A secret codicil to the massively inflated ECRL budget obtained by Sarawak Report in 2015 shows that the Chinese state construction company CCCC had privately agreed under the revised terms to cover the multi billion dollar repayments that were by then outstanding on debts raised by the Malaysian development fund 1MDB and also to buy out certain Jho Low controlled companies to the tune of a staggering $7.5 billion, a sum not too far shy of the $8 billion that the proposed SRIREF consortium was at the same time proposing to invest in Kuwait.

Schedule was drawn up to stage repayments of billions of dollars owing over coming years totalling US$7.463 billion

This was effectively a covert bail out of 1MDB by the Chinese including commissions to Jho Low, to be ultimately funded by Malaysian taxpayers. The purpose was to conceal the massive thefts orchestrated by Jho Low from the fund that came directly under the purview of his “Big Boss” Najib Razak (much of the money has been recorded as entering Najib’s accounts and those of his Hollywood producer stepson Riza Aziz).

He used to refer to his ‘Big Boss’ and my ‘Big Boss’. In my case the Big Boss was supposed to be the Kuwait prime minister and his son. In his case it was Najib.

explains Sarawak Report’s source in this matter.

Significantly, CCCC had itself emerged as one of the key named financial and construction partners in the SRIREF proposal by the Chinese Silk Road interests to Kuwait at this same period – in a deal that was of course being pulled together by Jho Low, the mastermind of the 1MDB thefts and attempted bailouts for Najib.

By this point in 2016 Jho Low had a parallel problem to the pressing need of his prime minister boss to somehow meet the debt and principal repayments by then owed by 1MDB, which was that by then his role in the thefts from the fund had been widely exposed. As a result, he had been forced on the run from international law enforcers and found himself shunned by the global banking system.

He was looking for safe channels to pass through the vast sums of money stolen from 1MDB and indeed the vast sums of money he now hoped to raise from the ECRL to pay some of it back.

The 17 page proposal to the Kuwaitis on the other hand referred to none of this back story in Malaysia. Instead it described the Silk Road project as a “Development Fund to be jointly sponsored by the designated investors from the State of Kuwait and People’s Republic of China”, as if it were a state to state affair. The key funders of the project were listed as CCCC and the Silk Road fund and there would be management fees available for a “designated Kuwait entity”.

State to State operation between Kuwait and China to be funded by Silk Road Corporation and CCCC, with management fees proposed for entities from Kuwait

The prospectus promoted the important and official status of the Silk Road fund and the role of two internationally known advisors, namely the former Goldman Sachs President and head of the Brookings Institute, John Lawson Thornton, and the former Secretary General of the EU, Javier Solana.

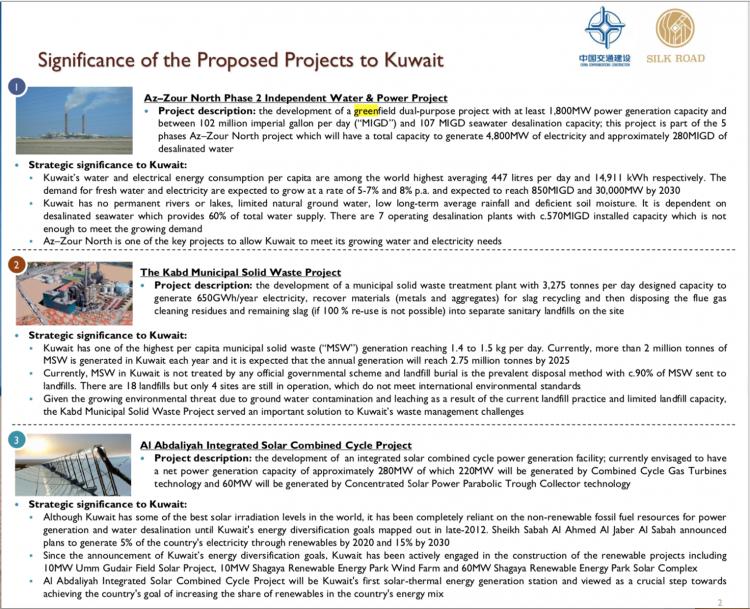

Three existing major infrastructure proposals were cited in the prospectus for Kuwait that would take many years of investment and the proposed fund was described as being divided into stages (much as the agreed repayments to 1MDB by CCCC had been staged up until 2022).

Significantly, a stage one for the fund involved a proposed up front transfer of US$1.2 billion in advance of the construction stages getting underway – an immediate transfer (see above). The purpose of this was not stated and on closer scrutiny some of those close to the Kuwaiti side of the deal questioned the genuine nature of the proposals.

Impressive global credentials

A Classic Jho Low Scheme

Sources close to the Al Sabah family’s involvement in these proposals say they were at first impressed with what appeared a genuine, Chinese state backed investment enterprise in Kuwait.

Nephew of President of China meeting with Sheikh Sabah in Kuwait April 20 2016

However, those familiar with the activities of Jho Low on behalf of his Malaysian prime ministerial backer will recognise hallmarks familiar to other schemes such as the ‘state to state’ joint ventures with PetroSaudi and with Abu Dhabi’s Aabar, which managed to obtain a public blessing from Crown Prince Sheikh Mohammad and his top advisor Khaldoon Al Mubarak.

The Kuwaiti initiative certainly fitted in with China’s aspirations to influence a swathe of emerging nations via its ambitious massive infrastructure investments, spearheaded by the Silk Road Fund.

However, there was another dimension. Key to Jho Low’s modus operandi was his networking with those close to the top decision makers – People who commanded respect in their countries because of who they were related to.

After a couple of exploratory visits in early 2016 Jho Low returned with an impressive delegation of Chinese officials and businessmen, accompanied by the Chinese Ambassador to Kuwait, to cement relations with a ceremonial set of meetings on April 20/21st.

Presenting gifts on arrival – Shekh Sabah and Shan Li

Amongst the visitors, say our sources, was the Chairman of the Silk Road Finance Corporation Mr Shan Li and a partner, Mr Joe Xiang and also none other than Mr. Xinyuan Liu, the nephew of the Chinese President Xi Jinping. The Al Sabah family were suitably impressed.

“Jho Low said he had made big money out of the Malaysians and now he planned to make billions out of the Chinese and we could be part of that” explains a source who was close to the Al Sabah family.

Jho Low took part in an arrival ceremony at the airport where gifts were presented and then went to the Al Sabah home where these gentlemen were entertained by Sheikh Sabah.

Here more food, photographs, gifts and speeches were made before the party was taken on a trip to the desert.

A participant in the ceremonials and business partner of Shekh Sabah told Sarawak Report:

“They had come to launch an initiative for a projected US$8bn infrastructure programme in Kuwait funded by Chinese investment. At the time the project seemed very high level, above board and professionally driven by the senior officers of Silk Road Integrated Fund.

However, I was struck at how these Chinese senior managers all deferred to this nephew of the President. Jho Low was acting as the agent for the nephew and the introducer of all these parties. He had explained to us that through this connection with the nephew of the President the 50 biggest companies in China could be involved in investing in Kuwait.

At the time I also thought it was very strange that this Malaysian personality should be driving such deals between these high-level players from China and Kuwait”

The following day at noon Sheikh Sabah and his brother Sheikh Fahd arranged for the group to be presented formally to their father, the prime minister, who in turn arranged for the group to meet the son of the Emir of Kuwait and to visit the Emirate’s existing Silk Island development project (also funded by China) before the party departed late afternoon.

Presenting gifts to Sheikh Sabah

“It was very professional” says a source connected to the arrangement, who was also impressed by the prospectus sent the following month.

However, these were major long term projects and the source says that what soon became strange was the immediate urgency on the part of Jho Low, who soon began pressing for funds to begin passing through the Kuwaiti side of the venture.

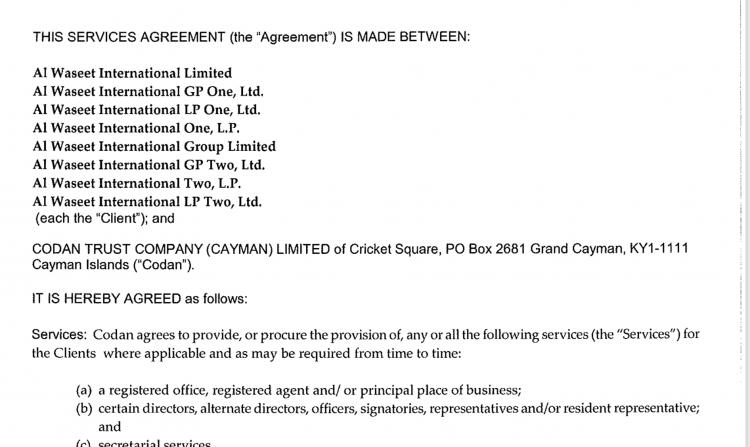

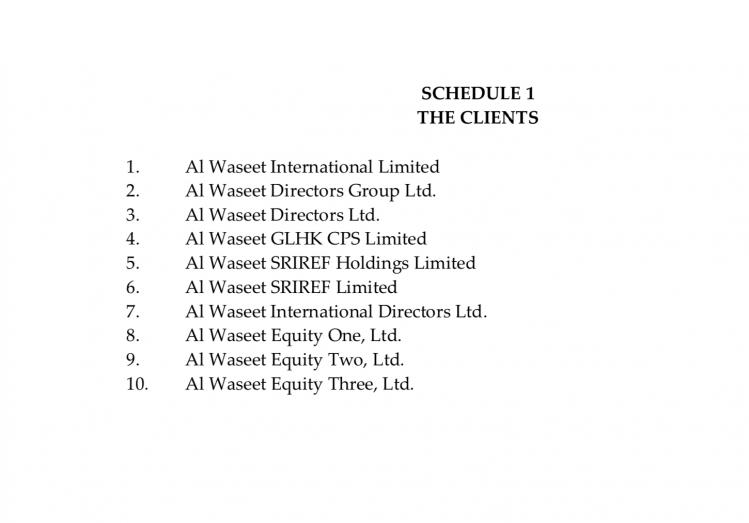

One of the companies in which Sheikh Sabah held a 20% but not a controlling interest in Kuwait was a major commercial group named Al Waseet, which had agreed to become part of the Kuwait side of the venture to facilitate the project.

An observer connected to Al Waseet says the money was not needed in these early stages and that none of the urgency made sense. He soon came to the conclusion that despite the professionalism of the Silk Road corporation, the proposed Kuwaiti mega-fund was being used as a ‘facade for something else': “It was to do a show and seduce – to show all the billions he can bring to the Al Sabah family” says the source.

More Bogus Off-shore Companies!

The alarm bells had first started ringing at Al Waseet when within just days of initial meetings with the Al Sabah family in February Jho Low had sent details of some 20 bogus companies that he had set up in various off-shore entities (primarily the BVI and Cayman Islands) that had been named to give the appearance of being subsidiaries of the well-established Al Waseet.

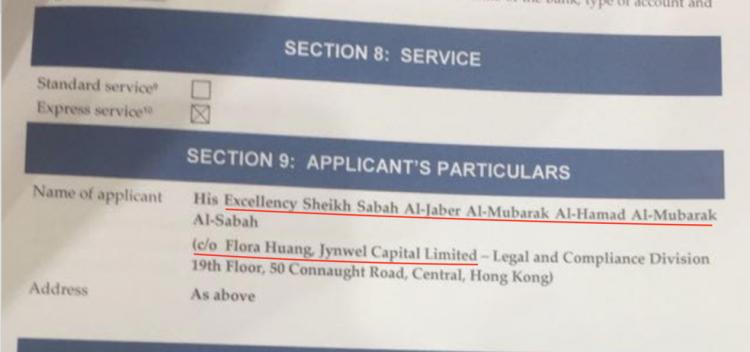

Sheikh Sabah only owned a 20% share of the actual Al Waseet group, however the bogus subsidiaries were all 100% in his name as the only registered shareholder. The contact name and address for these off-shore companies was none other than a member of staff in the legal and compliance division of Jho Low’s own company Jynwell Capital based in Hong Kong.

Jho Low had taken up the role as an advisor to the Al Sabah family as a strategic investor in the Silk Road project, but no role with Al Waseet.

Managed by a trust company in the Cayman Islands

The bogus BVI subsidiaries

All in the name of Sheikh Sabah, but organised through Jho Low’s Jynwel Capital in Hong Kong

The use of deceptive off-shore entities to disguise transfers of large sums of money has, of course, emerged as a signature method of Jho Low’s money laundering activities. Time and again he has used similar named companies to well known brands in order to give the impression that the transfers are being carried out by major corporations rather than mere shell companies controlled or owned by him.

We did not expect to be treated like this or to have the company put at risk. Sheikh Sabah had invited us to help facilitate his investments in Kuwait, to which we had agreed. But we had not expected this”.

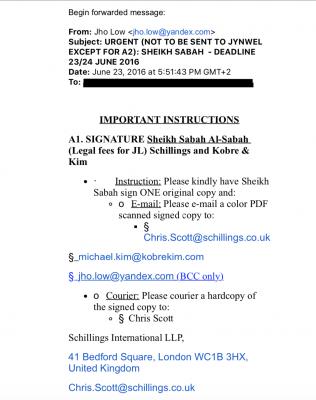

Messages sent from Jho’s Yanex account relating to payments to be made on his behalf by Sheikh Sabah

This was not the only aspect of Jho Low’s method of doing business that troubled one of the Sheikh’s key colleagues at a major Kuwaiti company in which the Sheikh held shares but not a controlling interest, Al Waseet.

The Malaysian financier was obsessive he says about secrecy in their communications, insisting on using special phones and private Russia based ‘Yandex’ accounts supposed to hide were, on the surface of it, normal business discussions.

“He gave me a Chinese phone with all these applications, even a mailbox on Yandex with my name!”

Notwithstanding such precautions, several of the messages and emails sent by Jho Low in this fashion clearly betray his identity as the author (see message trail).

Project Symphony – Offloading The Park Lane Hotel New York

Then, within days of the opening ceremonies in Kuwait, Al Waseet got a further flavour of Jho Low’s tactics and apparent hidden agenda, after a second set of ceremonies got underway over in China just four days later on 26th April.

The Al Waseet manager had understood that the China meetings were an extension of the same Silk Road engagement protocols and to announce the involvement of another investor in the planned Kuwaiti venture (also introduced by Jho Low) namely the Greenland corporation, a major development company headquartered in mainland China with a branch in Hong Kong, with whom Jho Low was dealing.

April 26ht 2016 – how Jho Low’s Park Lane Hotel holding was offloaded to Greenland Properties under the cover of the Kuwaiti al-Sabah Family and China’s Silk Road and Belt initiative

The company sent one of its directors to join Sheihk Sabah, the Kuwaiti Ambassador to China and their new Chinese counterparts in Shanghai to attend what was billed as a country to country event.

“Prime Minister’s Office informed the Chinese ambassador to Kuwait of the trip and its importance for bilateral relations and informed the Kuwaiti ambassador to Beijing Mr Mohamed Saleh who flew from Beijing to Shanghai with Kuwaiti officials to prepare for the reception of the delegation and the ceremony to be held with the flags and the national anthem”

according a source from Al Waseet. However, just before the main ceremony there was an unexpected development involving the company. The company director was instructed by Sheikh Sabah to enter a closed room to take part in the signing of an entirely separate deal involving the sale of Jho Low’s stake in the Park Lane Hotel in New York, which was about to be identified by the FBI as one of the major US assets bought with stolen 1MDB cash.

Mr. Yuliang Zhang, Chairman and President of Greenland Group, Exchanging Gift with HH Sheikh Sabah J M Al-S, according to official press release

The deal involved hundreds of pages of closely worded documents drawn up by lawyers (as yet to be identified) that the director was given no time to read, under the title of Project Symphony.

The transaction had the effect of first signing over the ownership of Jho Low’s company Jynwel’s share of the Park Lane Hotel In New York to the bogus Al Waseet International (BVI), one of the offshore subsidiaries created under the ownership of Sheikh Sabah and then immediately engaging in a share swap with Greeland Corporation in Hong Kong, who as a result emerged as the new owners of the shares in the hotel.

The deal left Al Waseet as the second largest shareholder in Greeland and it was then publicly announced that very day in a press release that described the transaction under the title ‘Project Lane Real Estate’ as if it were part of the state to state agreement for the $8 billion investment by the Chinese Silk Road Fund project in Kuwait, even though it merely related to a private property deal funded by stolen Malaysian money in New York.

The press release took care not to mention the identity of the New York property that had changed hands in the deal, describing it only as the ‘Park Lane Project’ and crucially gave the impression that Greeland had purchased the property from Al Waseet rather than the dubious Mr Jho Low.

“Situated at the core of Manhattan’s financial center, the site looks out to an unblocked panoramic view from Central Park to the Hudson River. The Park Lane project will be developed into a world’s top-notch luxury property project … Mr. Yuliang Zhang, Chairman and President of Greenland Group said, “Greenland Group has always been confident in US market and has developed many real estate projects in New York City and Los Angeles.….

The press release then went on to describe the separate Silk Road fund venture in Kuwait as if the projects were in some way connected.

In line with State President Xi’s “One Belt, One Road” vision to foster closer relationship between the People’s Republic of China and the Middle East as international strategic partners in terms of economic cooperation, cultural exchange, regional collaboration and financial platform construction, Kuwait Strategic Investor and Greenland Hong Kong will jointly establish the SRIREF with targeted fund size of US$8 billion, and will start in-depth cooperation with several Middle East sovereign funds in the future.

In short, in a lightening move enabled by careful legal preparation, Jho Low had off-loaded his real estate hot potato in New York to a top Chinese company, using as a front a respected major company in the Middle East and an entirely separate state to state deal between China and Kuwait.

“This way Jho Low avoided due diligence by the Chinese public company and the bank over the property, which would have normally accompanied such a sale”

says a source at Al Waseet.

With the company beginning to be compromised in this way, the situation had become difficult for its managers, who nevertheless clearly relied heavily on their relationship with the Al Sabah family in Kuwait and wanted to continue to please and profit, but within the normal boundaries.

Worse, over the coming weeks the Kuwaiti side were to become more and more aware of the concerns about Jho Low and his role in 1MDB, all of which had made him a toxic business partner on the global scene.

Comoros Bank

Meanwhile, Jho Low himself was clearly still scrambling to find paths to channel the vast sums under his control as global banking institutions and reputable businesses began to close their doors against him.

In this endeavour his new Kuwaiti and Chinese business partners were to become crucial players, Sarawak Report has found, and the Kuwaitis rapidly became sucked into further business plans that again had nothing to do with the initial development projects supposed to be the reason for the business relationship with the Al Sabah family.

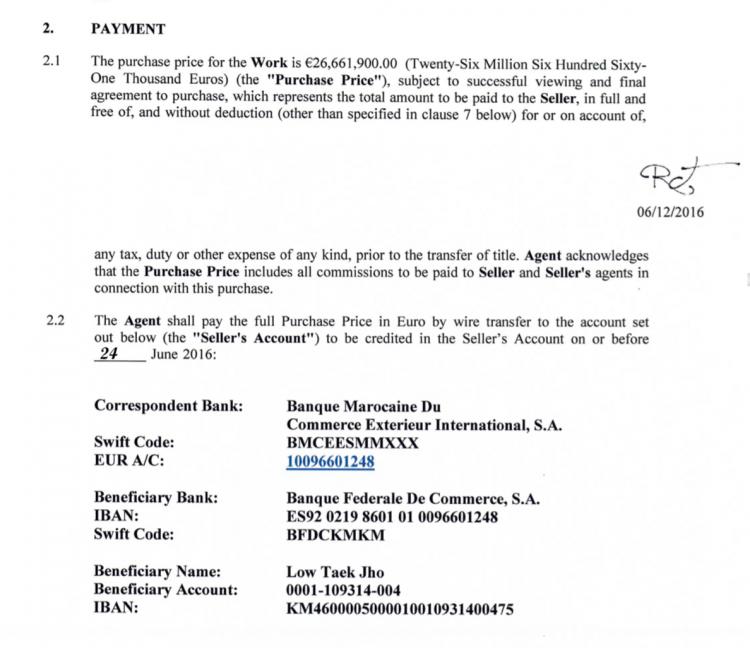

For example, Sheikh Sabah was the owner of a bank in the French speaking Comoros Islands BFC (Banque Federale de Commerce). Jho Low had announced he was keen to buy into a network of banks and told his Kuwaiti contacts he was also engaged in buying into a bank in Cyprus (a matter already exposed in Sarawak Report).

The reasons for Jho Low wanting his own bank were obvious. Sarawak Report has likewise reported that one of this close partners, the Thai businessman Laogumnerd, appears to have likewise invested in a Mauritius bank during the same period.

Jho Low came up with what appeared as an irresistible offer for the Sheikh Sabah, which was to buy 50% of BFC in the Comoros at a rate way above its capital value of just US$10 million for €35 million, as long as Sheikh Sabah agreed to remain as the other shareholder (key to adding a respectable and established front for such a remote off-shore concern).

It was at this point, following the June call containing the ‘good news’ about the Chinese agreeing to pick up the “silly situation” with 1MDB, that Jho Low explained to Sheikh Sabah that he would be able to pay for the share of the bank out of the first tranche of the US$3 billion commission promised by CCCC to Najib Razak in return for the inflation of the ECRL project.

Sarawak Report has viewed evidence that confirms the Kuwaiti prime minister’s son, Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah (Sheikh Sabah) agreed to cooperate by receiving the money through companies linked to himself in Kuwait.

Najib duly pushed the new ‘upgraded’ ECRL contract with CCCC through the Malaysian Cabinet in late July (the secret codicil containing the 1MDB repayment targets remaining hidden) and then went to China to ratify the project in November. Sarawak Report has learnt that whilst in Beijing Najib held at least two secret meetings with the fugitive Jho Low.

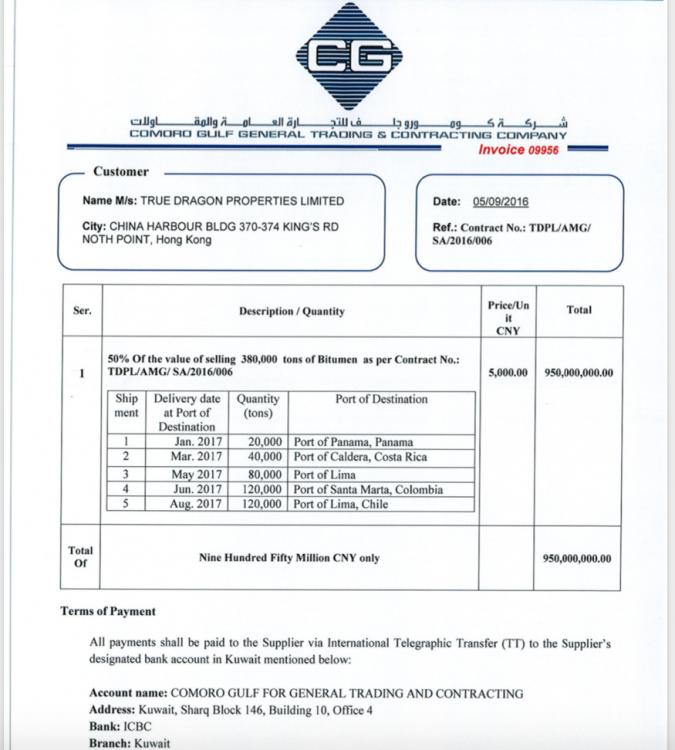

Meanwhile, in September, the first of the series of kickback payments amounting to 1.4 billion Chinese Yuan (€200 million) arrived in Kuwait, according to bank documents viewed by Sarawak Report, with the promise of a second identical tranche of money due the following month.

Invoice for CNY900,000,000.00 in return for ‘bitumen supplies’

Invoices and bank transfer documents viewed by Sarawak Report show that the first tranche of money was sent in two separate payments of CNY450 million and CNY900 million made by a Hong Kong based subsidiary of CCCC named True Dragon Properties.

The first CNY450 million arrived on 13th September into the newly opened Yuan currency account of a Kuwaiti company named Comoro Gulf General Trading & Contracting Company (CG) at the recently established Kuwait branch of the Chinese Bank (ICBC).

The owners of CG were Sheikh Sabah 5%, a business associate 49% and a sister company named KUC 46%. Evidence shows that the Sheikh and his associates accepted the payment, although it had been described as part of a US$3 billion backhander to Najib by Jho Low, whose own notoriety had become widespread owing to the asset seizures announced by the United States Department of Justice earlier in July.

Associates of the Al Sabah family involved in the negotiations say they knew that the money had nothing to do with the proposed relationship with Jho Low based on the Silk Road initiative, which was now being used as a front for transferring the Chinese state company’s backhanders to help Najib cover up 1MDB and secure the rail contract.

However, it was at this point that matters driven by Jho Low took a direction which led to ruptures with some of Sheikh Sabah’s business allies at the major established company Al Waseet, in which the Sheikh held a 20% shareholding.

The money had arrived in the Comoro Gulf General Trading & Contracting Company (CG) ICBC bank account in Yuan. However, Jho Low next explained that he had a number of ‘life or death’ invoices that now needed to be paid in western currencies, primarily to law firms who had assisted in his various dealings.

He wanted those payments to be made in the name of a known upstanding company, in order for them to be acceptable to the legal firms, and he therefore demanded that the Yuan should be transferred into an Al Waseet main business account in the (Bank of Kuwait) in euros, in order that the invoices could be paid by that company in Sheikh Sabah’s name as a front rather than the payment being seen to be for services to himself.

A series of instructions drawn up by Jho Low over the handling of the CNY450 million seen by Sarawak Report included a number of invoices from creditors, among them the law firms Kobre & Kim and Gibson Dun & Crutcher as well as the yacht management company WMG and a London based ‘concierge’ company which had all been made out to Sheikh Sabah Jaber Mubarak Al-Sabah “c/o Al Waseet International”.

Jho Low had also drawn up a document framing an elaborate story for ICBC Bank explaining the fictitious background to an alleged relationship between KG and CCCC based on the agreements between the Al Sabah family and the Silk Road Fund earlier in the year and referencing the press release from the Shanghai launch in June:

“Komoros Gulf for General Trading and Contracting Company (“Komoros Gulf”) is a company led by Sheikh Sabah Jaber Al-Sabah and his partners, and has been in discussions with China Communications Construction Company (“CCCC”) since June 2016 with respect to working with them on being a supplier for various items, together with potentially working with CCCC on projects in Kuwait. As you are aware, Sheikh Sabah Jaber Al-Sabah (one of the stakeholders of Komoros Gulf) is the eldest son of the Kuwait Prime Minister, and is very keen to establish strong cooperation between Kuwaiti and Chinese companies after his father’s excellent official visit to China the last few years. In fact, just a few months ago, Sheikh Sabah signed a partnership with China Government’s Greenland Group real estate developer to jointly form a US$8b “Silk Road Integrated Real Estate Fund (“SRIREF”) to invest in projects along the “One Belt, One Road” vision.

CNY450 million (US$63m) ‘Profit Margin’

As to why the money was not being used by CG to buy the bitumen requested by True Dragon Properties, but in fact to pay Jho Low’s various bills, Jho to told his Kuwaiti fixers:

The explanation to ICBC Kuwait Bank is that when the next CNY450 million is received, then this will be used to pay for the Bitumen supply to fulfil the contract. Effectively, the first CNY 450 million is the profit margin.

Jho Low’s strategies posed an immediate threat to Al Waseet International’s credibility. By now Jho Low was a known financial fugitive on the run and this would be processing a vast sum of stolen money on his behalf through a respectable company with international clients.

“We have auditors and bankers and lawyers to satisfy and could not afford to have this money come through the firm under false pretences”

says one person familiar with the situation.

Meanwhile, the position with BFC Bank in the Comoros had also become scandalous. The chief executive of the Bank in the Comoros had already sent a written request not to proceed with the share sale as he had himself received a warning from his own clearing bank about receiving payments of some two million dollars into the account opened by Jho Low.

The clearing bank would cease to do business with them he explained. Later in December an attempt to process over €26 million from the sale of another Monet through the bank would be stopped, thanks to interventions by the FBI. However, the BFI chief executive took the blame and was imprisoned in the Comoros over the dealings with Jho Low.

Money for Monet transferred to Comoros Island Bank owned by Sheikh Sabah in December 2016

“Jho Low had organised a series of fake invoices to justify the 1.4 million yuan payments, which was extremely worrying. They claimed that Al Waseet was sourcing bitumen for CCCC to employ in projects in Africa and South America, which was completely untrue and ridiculous. Next, he was producing fake invoices for payments by Al Waseet to the various law firms he owed money to, either into euro or dollar accounts. This went right over the boundaries and was very blatant corruption”

a source has told Sarawak Report. After the first series of transactions relating to the CNY450 million were processed therefore the businessman connected to Al Waseet terminated the company’s connections with these dealings.

As part of a separation deal all interests in the Comoro Gulf General Trading & Contracting Company were signed over, in a Letter of Agreement drawn up by Jho Low, to Sheikh Sabah at no cost. The invoices which had been presented c/o Al Waseet were paid out of the CG account.

Letter of Agreement to remove Al Waseet from arrangements between Sheikh Sabah and Jho Low

“I contacted Jho Low and told him that I could not cooperate in this matter and I needed to cease to be involved. I explained that I had seen a ten page banking document detailing his misdemeanors and that he was wanted by the law. He became very angry and asked if I was threatening him. He accused me of disloyalty to my “Boss”.

says a former manager linked to these dealings. The episode was to be a turning point in the businessman’s relations in Kuwait as he ceased to do further business with the Al Sabah family and soon became the target, together with his family and associates, of numerous legal attacks by the Al Sabah family.

However, he has confirmed to Sarawak Report his sure understanding that payments continued to be transferred from CCCC to Sheikh Sabah on behalf of Jho Low and Najib as planned over following months, including to a new company that Sheikh Al Sabah created in oct 2016 to continue the transactions named Al Mouniratayen General Trading.

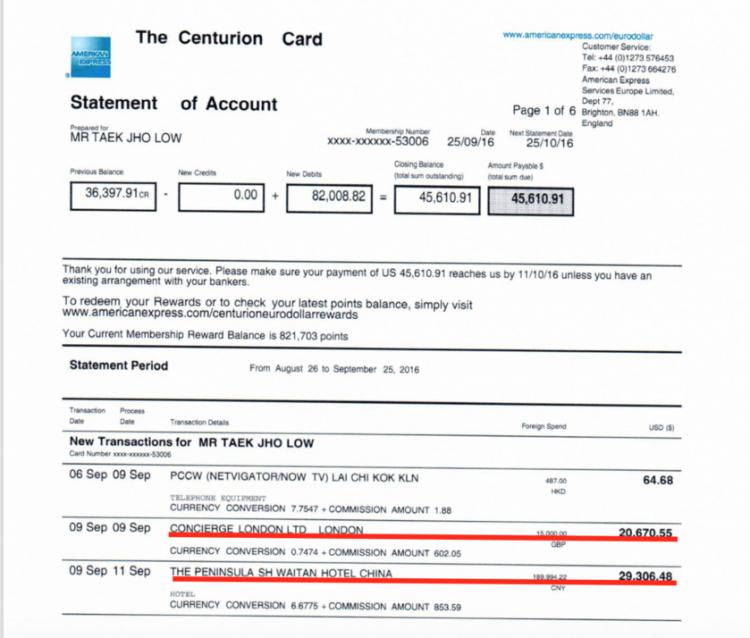

Sarawak Report has viewed invoices that confirm that Jho Low continued during this period to hide out in China, using his new Comoros Island bank account to settle bills with the Peninsular Hotel in Shanghai for example:

Jho Low’s Amex payments in 2016 connect him to the Peninsular Hotel Shanghai. He funded himself through the sale of a Monet through Sotheby’s paid into the Sheikh Sabah owned BFC bank in the Comoros Islands

Jho Low had also managed to acquire a series of island nation passports thanks to the services of another company, Henley & Partners, in particular from St Kitts & Nevis and also Cyprus, giving him valuable access to the European area.

His new business friends in Kuwait meanwhile were tasked with smoothing his path into their own country by arranging VIP business visas for himself and his long-term sidekick Seet Li Lin.

Jho Low’s visa to Kuwait

Thanks to this latest informationSarawak Report has therefore been able to fill in the gaps in Jho Low’s known business activities during this same period as he sought to get himself and Najib off the hook over 1MDB in 2016/17.

It is clear that he was being protected in China not least because he had developed a number of highly placed contacts for whom he was promising lucrative opportunities in Malaysia and now Kuwait.

These exclusive revelations leave both countries with major questions to answer at the highest official levels regarding their involvement in Malaysia’s financial scandal of the decade.

The prime minister of Kuwait, father of Sheikh Sabah, was removed from office last November amidst allegations of corruption in an unusual scandal for the close-knit family-run Arab state. However, there is no confirmation as to whether the matters of concern were connected to the family’s close involvement with Jho Low’s thefts from Malaysia relating to 1MDB.

Jho Low with Kuwaiti dignitaries and Greenland Properties celebrate the Park Lane Hotel deal in Shanghai April 2016