by Ganesh Sahathevan

Michelle Chan is considered a South East

Asian expert .She was until recently

PM Scott Morrison's National Security

Adviser

Michelle Chan is considered a South East

Asian expert .She was until recently

PM Scott Morrison's National Security

Adviser

Most Australians would not have heard of the Chinese Government controlled Greenland Property Group and its activities in Australia until recently when Greenland started raiding retail outlets to secure stocks of surgical masks and other equipment for China in its fight against the Wuhan Virus. The raid, as reported by News.com and others:

A Chinese government-backed property giant has secretly raided in bulk Australia’s supplies of masks, hand sanitiser, antibacterial wipes and essential medical supplies and shipped them back to China.

The Greenland Group, which manages high-end real estate projects in Sydney and Melbourne, proactively drained Australian supplies of anti-coronavirus equipment, The Sydney Morning Herald reported.

Three million surgical masks, 500,000 pairs of gloves and bulk supplies of sanitiser and wipes were bought up in Australia and other countries where Greenland operates.

While the bulk purchases and shipping were perfectly legitimate, the goods shipped in bulk to China include the very items that have been in short supply for Australian citizens as well as health professionals.

They were accumulated at Greenland’s Sydney headquarters and sent to China over weeks in January and February.

As coronavirus locked down Wuhan, the global Fortune 500 company put its normal work on hold and instructed staff in Australia, Canada, Turkey and elsewhere to source supplies.

Pallet loads of items including thermometers and 700,000 hazmat suits were sent to China, the Herald reported.

Greenland deployed its HR staff members, contract managers and others away from their desks to go out and amass as many of the items as possible.

It was reported Greenland’s Australian managing director Sherwood Luo even posted about it on social media.

That Greenland was acting against Australian interest and in favour of China is unsurprising given its record in promoting Xi Jin Ping's Silk Road/BRI.

Investigative news site Sarawak Report has disclosed that Greenland has had involvement in Malaysia's 1MDB scandal, apparently woking in tandem with John Holland owner China Communications And Construction Company (CCCC).

Despite Greenland's part in what has been described as the biggest case of kleptocracy the world has ever seen, there have not been any restraints or controls placed on its activities in Australia.The 1MDB scandal has been in the public domain since 2015.

It does appear, again, that Australian government intelligence on the Silk Road/BRI is false. The intelligence failure reaches to the highest levels of government for PM Scott Morrison's national security adviser at all relevant times, Michelle Chan, is a highly regarded South East Asian expert. That Chan was not aware of what has been uncovered and published by a former BBC reporter operating out of her apartment in London is inconceivable.

She should be required to explain her failure, as should the current Ambassador to China Graham Fletcher.

TO BE READ WITH THE FOLLOWING EXCERPT FROM SARAWAK REPORT STORY

Project Symphony – Offloading The Park Lane Hotel New York

Then, within days of the opening ceremonies in Kuwait, Al Waseet got a further flavour of Jho Low’s tactics and apparent hidden agenda, after a second set of ceremonies got underway over in China just four days later on 26th April.

The Al Waseet manager had understood that the China meetings were an extension of the same Silk Road engagement protocols and to announce the involvement of another investor in the planned Kuwaiti venture (also introduced by Jho Low) namely the Greenland Property Group, a major development company headquartered in mainland China with a branch in Hong Kong, with whom Jho Low was dealing.

April 26ht 2016 – how Jho Low’s Park Lane Hotel holding was offloaded to Greenland Properties under the cover of

the Kuwaiti al-Sabah Family and China’s Silk Road and Belt initiative

The company sent one of its directors to join Sheihk Sabah, the Kuwaiti Ambassador to China and their new Chinese counterparts in Shanghai to attend what was billed as a country to country event.

“[The Kuwaiti] Prime Minister’s Office informed the Chinese ambassador to Kuwait of the trip and its importance for bilateral relations and informed the Kuwaiti ambassador to Beijing, Mr Mohamed Saleh, who flew from Beijing to Shanghai with Kuwaiti officials to prepare for the reception of the delegation and the ceremony to be held with the flags and the national anthem”

according a source from Al Waseet. However, just before the main ceremony there was an unexpected development involving the company. The company director was instructed by Sheikh Sabah to enter a closed room to take part in the signing of an entirely separate deal involving the sale of Jho Low’s stake in the Park Lane Hotel in New York, which was about to be identified by the FBI as one of the major US assets bought with stolen 1MDB cash.

Mr. Yuliang Zhang, Chairman and President of Greenland Group, Exchanging Gift with HH Sheikh Sabah J M Al-S, according to official press release

The deal involved hundreds of pages of closely worded documents drawn up by lawyers (as yet to be identified) that the director was given no time to read, under the title of Project Symphony.

The transaction had the effect of first signing over the ownership of Jho Low’s company Jynwel’s share of the Park Lane Hotel In New York to the bogus Al Waseet International (BVI), one of the offshore subsidiaries created under the ownership of Sheikh Sabah and then immediately engaging in a share swap with Greeland Corporation in Hong Kong, who as a result emerged as the new owners of the shares in the hotel.

The deal left Al Waseet as the second largest shareholder in Greeland and it was then publicly announced that very day in a press release that described the transaction under the title ‘Project Lane Real Estate’ as if it were part of the state to state agreement for the $8 billion investment by the Chinese Silk Road Fund project in Kuwait, even though it merely related to a private property deal funded by stolen Malaysian money in New York.

The press release took care not to mention the identity of the New York property that had changed hands in the deal, describing it only as the ‘Park Lane Project’ and crucially gave the impression that Greeland had purchased the property from Al Waseet rather than the dubious Mr Jho Low.

“Situated at the core of Manhattan’s financial center, the site looks out to an unblocked panoramic view from Central Park to the Hudson River. The Park Lane project will be developed into a world’s top-notch luxury property project … Mr. Yuliang Zhang, Chairman and President of Greenland Group said, “Greenland Group has always been confident in US market and has developed many real estate projects in New York City and Los Angeles.….

The press release then went on to describe the separate Silk Road fund venture in Kuwait as if the projects were in some way connected.

In line with State President Xi’s “One Belt, One Road” vision to foster closer relationship between the People’s Republic of China and the Middle East as international strategic partners in terms of economic cooperation, cultural exchange, regional collaboration and financial platform construction, Kuwait Strategic Investor and Greenland Hong Kong will jointly establish the SRIREF with targeted fund size of US$8 billion, and will start in-depth cooperation with several Middle East sovereign funds in the future.

In short, in a lightening move enabled by careful legal preparation, Jho Low had off-loaded his real estate hot potato in New York to a top Chinese company, using as a front a respected major company in the Middle East and an entirely separate state to state deal between China and Kuwait.

“This way Jho Low avoided due diligence by the Chinese public company and the bank over the property, which would have normally accompanied such a sale”

says a source at Al Waseet.

With the company beginning to be compromised in this way, the situation had become difficult for its managers, who nevertheless clearly relied heavily on their relationship with the Al Sabah family in Kuwait and wanted to continue to please and profit, but within the normal boundaries.

Worse, over the coming weeks the Kuwaiti side were to become more and more aware of the concerns about Jho Low and his role in 1MDB, all of which had made him a toxic business partner on the global scene.

Comoros Bank

Meanwhile, Jho Low himself was clearly still scrambling to find paths to channel the vast sums under his control as global banking institutions and reputable businesses began to close their doors against him.

In this endeavour his new Kuwaiti and Chinese business partners were to become crucial players, Sarawak Report has found, and the Kuwaitis rapidly became sucked into further business plans that again had nothing to do with the initial development projects supposed to be the reason for the business relationship with the Al Sabah family.

The reasons for Jho Low wanting his own bank were obvious. Sarawak Report has likewise reported that one of this close partners, the Thai businessman Laogumnerd, appears to have likewise invested in a Mauritius bank during the same period.

Jho Low came up with what appeared as an irresistible offer for the Sheikh Sabah, which was to buy 50% of BFC in the Comoros at a rate way above its capital value of just US$10 million for €35 million, as long as Sheikh Sabah agreed to remain as the other shareholder (key to adding a respectable and established front for such a remote off-shore concern).

It was at this point, following the June call containing the ‘good news’ about the Chinese agreeing to pick up the “silly situation” with 1MDB, that Jho Low explained to Sheikh Sabah that he would be able to pay for the share of the bank out of the first tranche of the US$3 billion commission promised by CCCC to Najib Razak in return for the inflation of the ECRL project.

Sarawak Report has viewed evidence that confirms the Kuwaiti prime minister’s son, Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah (Sheikh Sabah) agreed to cooperate by receiving the money through companies linked to himself in Kuwait.

Najib duly pushed the new ‘upgraded’ ECRL contract with CCCC through the Malaysian Cabinet in late July (the secret codicil containing the 1MDB repayment targets remaining hidden) and then went to China to ratify the project in November. Sarawak Report has learnt that whilst in Beijing Najib held at least two secret meetings with the fugitive Jho Low.

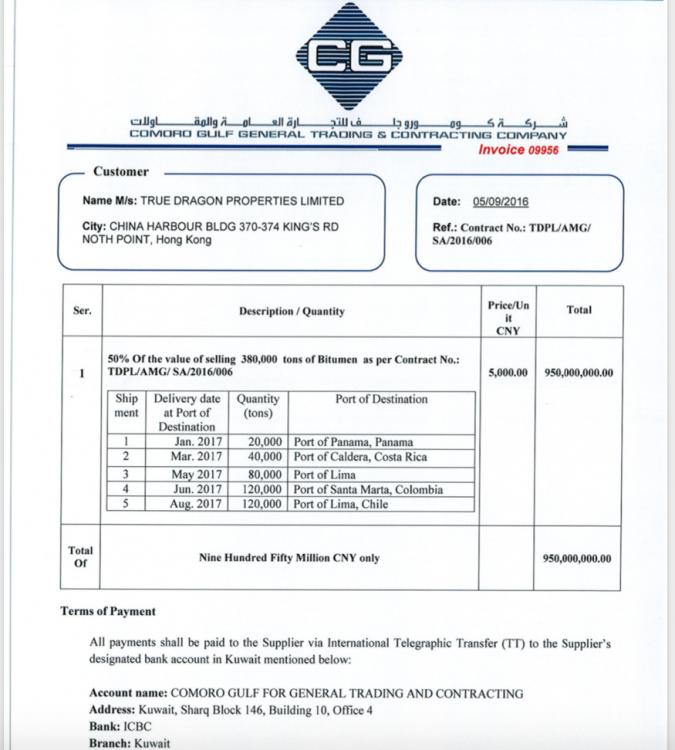

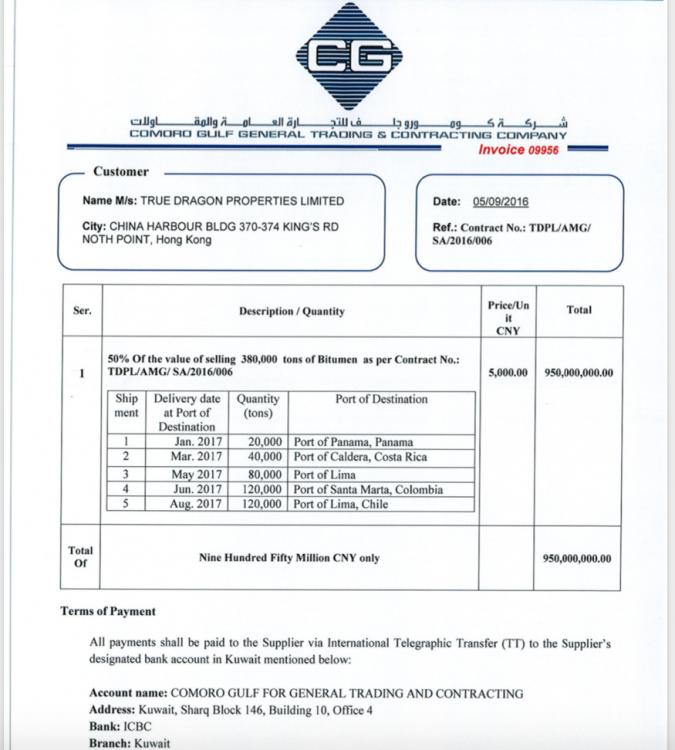

Meanwhile, in September, the first of the series of kickback payments amounting to 1.4 billion Chinese Yuan (€200 million) arrived in an account in the name of a Kuwait registered concern, Comoro Gulf General Trading & Contracting Company (CG/ Komoros Gulf) at the newly established branch of China’s ICIB Bank in Kuwait, according to bank documents viewed by Sarawak Report, with the promise of a second identical tranche of money due the following month.

An explanatory document for the bank entitled “For ICBC” was drawn up by Jho Low to be presented to account managers to explain the transfers as being part of the arrangement between the Silk Road Fund and Al Sabah family, citing the event with Greenland Property Group earlier in the year in Shanghai:

Background of Transaction and Intention of Funds

- Komoros Gulf for General Trading and Contracting Company (“Komoros Gulf”) is a company led by Sheikh Sabah Jaber Al-Sabah and his partners, and has been in discussions with China Communications Construction Company (“CCCC”) since June 2016 with respect to working with them on being a supplier for various items, together with potentially working with CCCC on projects in Kuwait.

- As you are aware, Sheikh Sabah Jaber Al-Sabah (one of the stakeholders of Komoros Gulf) is the eldest son of the Kuwait Prime Minister, and is very keen to establish strong cooperation between Kuwaiti and Chinese companies after his father’s excellent official visit to China the last few years.

- Infact, just a few months ago, Sheikh Sabah signed a partnership with China Government’s Greenland Group real estate developer to jointly form a US$8b “Silk Road Integrated Real Estate Fund (“SRIREF”) to invest in projects along the “One Belt, One Road” vision…

explained the document. It then went on to claim that ‘Komoros Gulf’ had entered into an agreement linked to this activity to supply bitumen to CCCC in both Africa and South America at advantageous rates. To justify the enormous payments they supplied copies to the bank of supposed invoices to CCCC run up by these activities:

Invoice for CNY900,000,000.00 in return for ‘bitumen supplies’

The owners of CG were Sheikh Sabah 5%, a business associate 49% and a sister company named KUC 46%. The first CNY450 million arrived on 13th September into the newly opened Yuan currency account at the bank.

Invoices and bank transfer documents viewed by Sarawak Report show that the September transfer was due to be sent in two separate payments of CNY450 million and CNY900 million made from a Hong Kong based subsidiary of CCCC named True Dragon Properties. A second identical payment was scheduled for October.

Evidence shows that the Sheikh and his associates accepted the payment, although they had been privately led to understand that it was part of a US$3 billion backhander to Najib by Jho Low, whose own notoriety had become widespread owing to the asset seizures announced by the United States Department of Justice earlier in July.

Associates of the Al Sabah family involved in the negotiations confirm that despite the misleading document drawn up for the bank they knew that the money had nothing to do with the proposed Silk Road initiative, which was now being used as a front for transferring the Chinese state company’s backhanders to help Najib cover up 1MDB and secure the rail contract.

However, it was at this point that these machinations driven by Jho Low took a direction which led to ruptures with some of Sheikh Sabah’s business allies at the major established company Al Waseet, in which the Sheikh also held a 20% shareholding.

Straight after the money had arrived in the Comoro Gulf General Trading & Contracting Company (CG) ICBC bank account in Chinese yuan, Jho Low explained that he had a number of ‘life or death’ invoices that now needed to be paid in western currencies, primarily to law firms who had assisted in his various dealings.

Crucially however, he wanted those payments to be made in the name of a known upstanding company, in order for them to be acceptable to the legal firms, and he therefore demanded that a large chunk of the Chinese yuan should be transferred into an Al Waseet main business account in the (Bank of Kuwait) in euros, in order that the invoices could be paid by that company in Sheikh Sabah’s name as a front rather than the payment being seen to be for services to himself.

As detailed in an earlier expose by Sarawak Report, Sheikh Sabah had indeed entered into agreements with a number of law firms and other creditors of Jho Low to cover their fees (given that the businessman could no longer access the global banking system as a wanted fraudster).

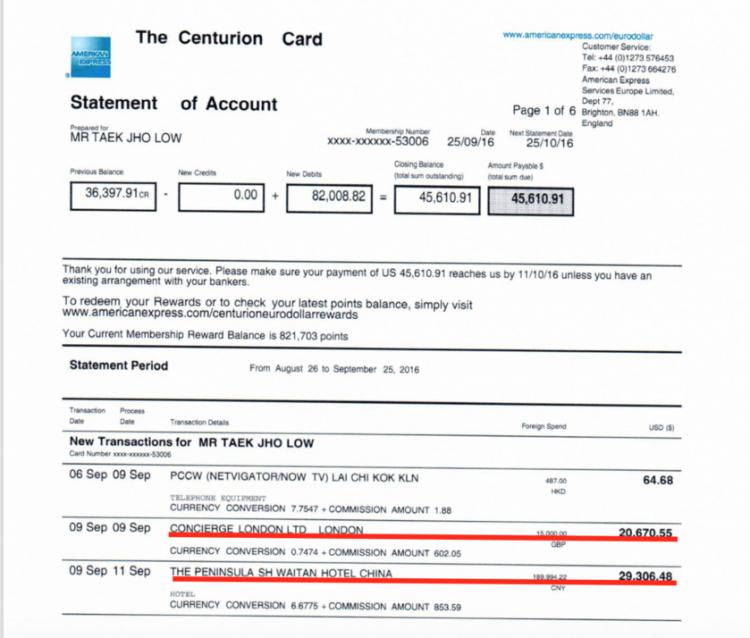

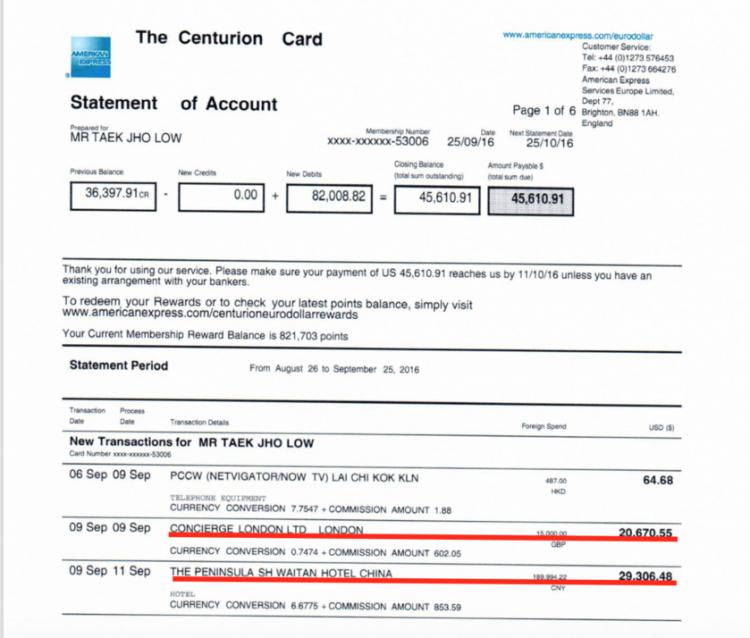

A series of instructions drawn up by Jho Low over the handling of the CNY450 million seen by Sarawak Report included a number of invoices from creditors, among them the law firms Kobre & Kim and Gibson Dun & Crutcher as well as the yacht management company WMG and a London based ‘concierge’ company which had all been made out to Sheikh Sabah Jaber Mubarak Al-Sabah “c/o Al Waseet International”.

CNY450 million (US$63m) ‘Profit Margin’

As to why the money was not being used by CG to buy the bitumen requested by True Dragon Properties, but in fact to pay Jho Low’s various bills, Jho to told his Kuwaiti fixers:

The explanation to ICBC Kuwait Bank is that when the next CNY450 million is received, then this will be used to pay for the Bitumen supply to fulfil the contract. Effectively, the first CNY 450 million is the profit margin.

Jho Low’s strategies posed an immediate threat to Al Waseet International’s credibility. By now Jho Low was a known financial fugitive on the run and this would be processing a vast sum of stolen money on his behalf through a respectable company with international clients. “We had auditors and bankers and lawyers to satisfy and could not afford to have this money come through the firm under false pretences”, says one person familiar with the situation.

Meanwhile, the position with BFC Bank in the Comoros had also become scandalous. The chief executive of the Bank in the Comoros had already sent a written request not to proceed with the share sale as he had himself received a warning from his own clearing bank about receiving payments of some two million dollars into the account opened by Jho Low.

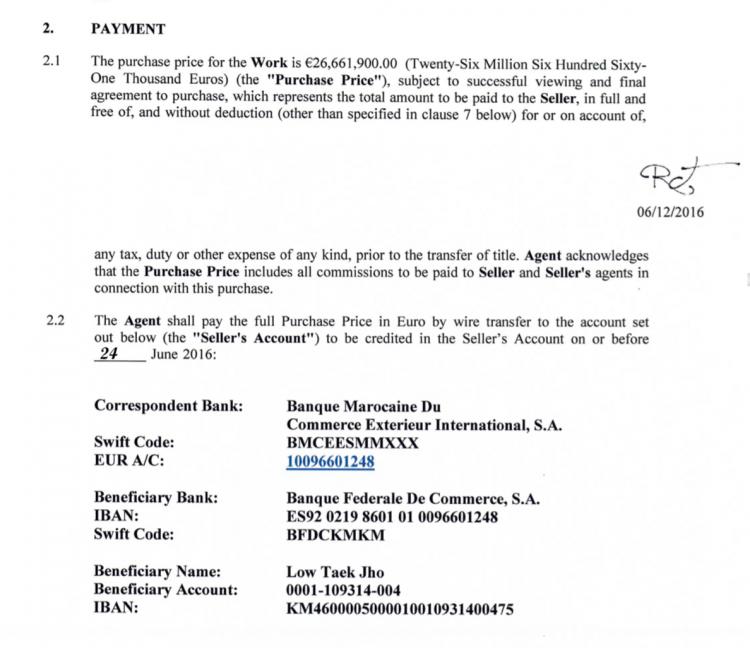

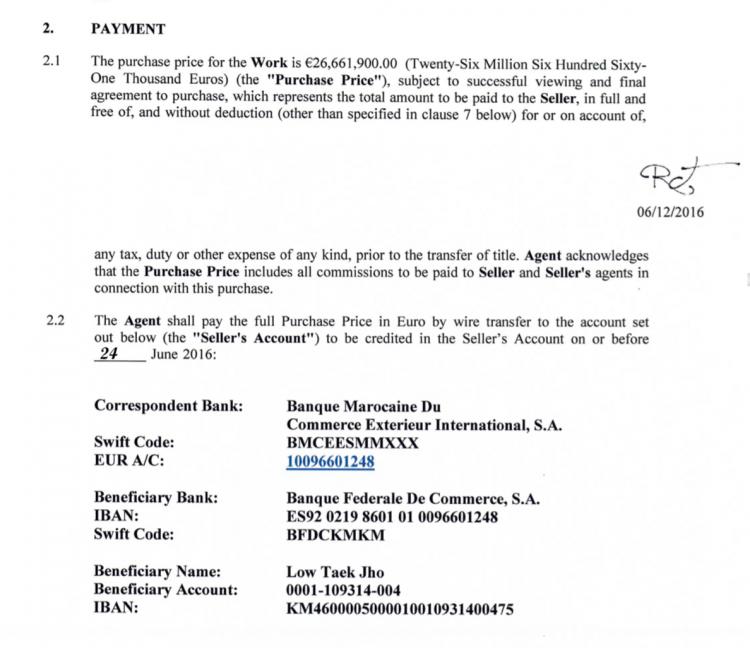

The clearing bank would cease to do business with them he explained. Later in December an attempt to process over €26 million from the sale of another Monet through the bank would be stopped, thanks to interventions by the FBI. However, the BFI chief executive took the blame and was imprisoned in the Comoros over the dealings with Jho Low.

Money for Monet transferred to Comoros Island Bank owned by Sheikh Sabah in December 2016

“Jho Low had organised a series of fake invoices to justify the 1.4 million yuan payments, which was extremely worrying. Next, he was producing fake invoices for payments by Al Waseet to the various law firms he owed money to, either into euro or dollar accounts. This went right over the boundaries and was very blatant corruption”

a source has told Sarawak Report. After the first series of transactions relating to the CNY450 million were processed therefore the businessman connected to Al Waseet terminated the company’s connections with these dealings.

As part of a separation deal all interests in the Comoro Gulf General Trading & Contracting Company were signed over, in a Letter of Agreement drawn up by Jho Low, to Sheikh Sabah at no cost. In return the invoices which had been presented to Sheikh Sabah c/o Al Waseet were paid out of the CG account and not Al Waseet.

Letter of Agreement to remove Al Waseet from arrangements between Sheikh Sabah and Jho Low

“I contacted Jho Low and told him that I could not cooperate in this matter and I needed to cease to be involved. I explained that I had seen a ten page banking document detailing his misdemeanors and that he was wanted by the law. He became very angry and asked if I was threatening him. He accused me of disloyalty to my “Boss”.

says a former manager linked to these dealings. The episode was to be a turning point in the businessman’s relations in Kuwait as he ceased to do further business with the Al Sabah family and soon became the target, together with his family and associates, of numerous legal attacks by the Al Sabah family.

However, he has confirmed to Sarawak Report his sure understanding that payments continued to be transferred from CCCC to Sheikh Sabah on behalf of Jho Low and Najib as planned over following months, including to a new company that Sheikh Al Sabah created in oct 2016 to continue the transactions named Al Mouniratayen General Trading.

Sarawak Report has viewed invoices that confirm that Jho Low continued during this period to hide out in China, using his new Comoros Island bank account to settle bills with the Peninsular Hotel in Shanghai for example:

Jho Low’s Amex payments in 2016 connect him to the Peninsular Hotel Shanghai. He funded himself through the sale of a Monet through Sotheby’s paid into the Sheikh Sabah owned BFC bank in the Comoros Islands

Jho Low had also managed to acquire a series of island nation passports thanks to the services of another company, Henley & Partners, in particular from St Kitts & Nevis and also Cyprus, giving him valuable access to the European area.

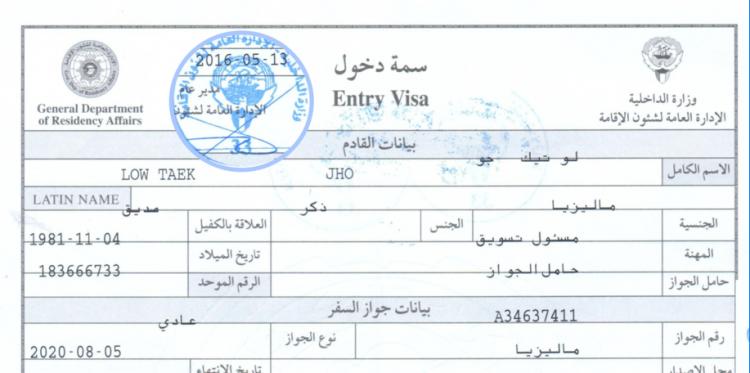

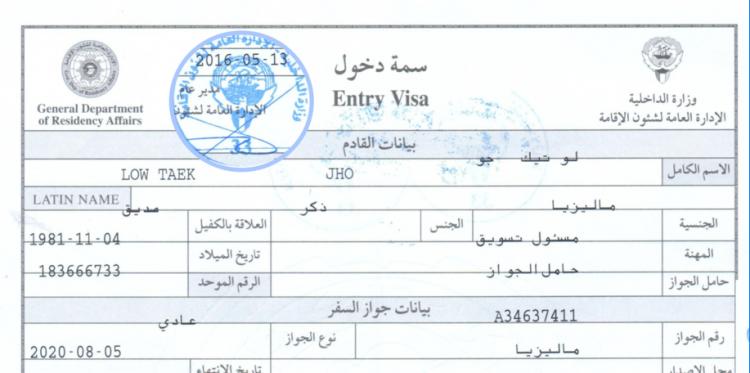

His new business friends in Kuwait meanwhile were tasked with smoothing his path into their own country by arranging VIP business visas for himself and his long-term sidekick Seet Li Lin.

Jho Low’s visa to Kuwait

Thanks to this latest informationSarawak Report has therefore been able to fill in the gaps in Jho Low’s known business activities during this same period as he sought to get himself and Najib off the hook over 1MDB in 2016/17.

It is clear that he was being protected in China not least because he had developed a number of highly placed contacts, including the nephew of the President of China, for whom he was acting as an agent and promising lucrative opportunities in Malaysia and now Kuwait.

These exclusive revelations leave both countries with major questions to answer at the highest official levels regarding their involvement in Malaysia’s financial scandal of the decade.

The prime minister of Kuwait, father of Sheikh Sabah, was removed from office last November amidst allegations of corruption in an unusual scandal for the close-knit family-run Arab state. However, there is no confirmation as to whether the matters of concern were connected to the family’s close involvement with Jho Low’s thefts from Malaysia relating to 1MDB.

Jho Low with Kuwaiti dignitaries and Greenland Properties celebrate the Park Lane Hotel deal in Shanghai April 2016